A Self-Managed Super Fund (SMSF) is both a financial opportunity and a legal responsibility. Due to the abundance of SMSFs in Australia, which control billions of assets (over 600,000 SMSFs as of date), SMSF trustees and advisors are under immense pressure to ensure the strict adherence to ATO guidelines, whether it is in administration, SMSF reporting, or annual audit verification.

Outsourcing SMSF administration is a strategic decision for many: it saves time, is more accurate, and guarantees compliance. This strategic decision can free up your time to focus on more strategic aspects of your business, ensure accurate and timely reporting, and provide peace of mind that your fund complies with regulations. But this only happens when you outsource to a provider who knows the Australian super laws and its secure systems and offers audit-ready services on time.

Making a poor decision on who to contract may result in errors, penalties, and breaches, which could jeopardize the compliance of your fund. As a trustee, accountant, or advisor, to secure its funds and ensure smooth operations, it is vital to choose a trusted partner. These consequences can lead to financial losses, legal issues, and reputational damage. Selecting an outsourcing partner is a critical decision.

Then, how do you identify the best outsourcing partner you need for your SMSF? Here are the key points to note.

Key Factors When Choosing an SMSF Accounting Outsourcing Provider

The choice of an outsourcing SMSF administration partner is not entirely about money but about SMSF compliance, security, and long-term relationships. The ATO has stringent criteria regarding how self-managed super funds have to be administered and audited, and your provider must not only make your work easier but also assist you in fulfilling the legal requirements. The list of five critical items to consider is given below:

1. End-to-end SMSF Administration auditing services

A good provider should offer full-spectrum services, encompassing the entire SMSF lifecycle, from fund setup to lodgement of tax returns. This reduces the chances of error and miscommunication that may occur when various tasks are assigned to different vendors.

Find a provider that offers:

- Fund setup and registration of compliance: Support the establishment of a trust deed, application for an ABN/TFN, and compliance registration with the ATO.

- Day-to-day administration and bookkeeping: Administration of contributions, rollovers, pensions, and reconciliation to banks.

- Creation of annual financials and tax: Preparation of financial statements by the Australian SMSF accounting standards.

- ATO lodgement and trustee reporting: Proper and punctual ATO lodgement, which minimizes the chances of a non-compliance fine.

A one-stop SMSF service is time-saving and consistent and enables trustees to focus on investment decisions instead of managing back-office tasks.

2. Audit-Readiness and ATO Compliance

Self-managed super funds have no option but to undergo ATO audits. Your provider is expected to maintain your fund in a highly audit-ready position throughout the year, not just at the close of the financial year. Documents that are late or not received may result in fines by the ATO or the removal of trustees.

An audit-ready provider must provide:

- ATO-standard documentation: Correct keeping of minutes, declarations, investment strategies, and trustee statements.

- Engagement of SMSF-registered auditors: Outsourcing partners must ensure that they engage auditors with SMSF management providers that meet their needs through access to independent and compliant audits.

- Real-time compliance: Alerts and monitoring to provide alerts when there are breaches of the requirements, such as early access to funds or contribution limits.

- Remediation and breach SMSF management: Advice on addressing instances to prevent their progression to serious attention from the ATO.

SMSF compliance emphasis also reduces audit anxiety and helps trustees avoid being in poor standing with the ATO.

3. Data Safety and Security Technology

As SMSF accounting services are digitized, your provider needs to have access to superior software and effective cybersecurity measures. Effective technology not only speeds up processing but also ensures the privacy of data, a key parameter under Australian data protection law.

Make sure that the provider employs:

- Encrypted client portals: Document sharing and communications channels.

- Bank/investment streaming: Real-time bank and investment data streams and automatic import of transactions to prevent manual entries and errors.

- Access documents in the cloud: Access fund-related documents anytime and anywhere, which is beneficial for both trustees and accountants.

- Workflow tracking dashboards: Ability to track task progress, initiation, and deadlines.

Providers that are enabled with technology ensure that the SMSF becomes much quicker, safer, and more transparent to manage.

4. Local Knowledge and Regulatory Insight

Although offshoring specific duties may be a good idea, your provider should possess a high level of expertise in Australian SMSF legislation and ATO rules. Having a team that understands the domestic legislative structure would help avoid erroneous interpretations of policies and reporting.

Among the essential factors, one should take into consideration the following:

- Familiarity with SIS Act and superannuation rulings: A necessary element of properly administering a fund.

- Mobilized support teams in Australian time zones: This enables the resolution of problems or support for trustees in real-time.

- Searchability and locality: Companies that appear in search results for an SMSF accountant near me typically prioritize regional trust and customer locality.

- Dynamic response to ATO updates: The ATO environment of SMSFs is dynamic, and any provider should keep their fund in line with the latest changes.

The result of local know-how and outsourcing efficiencies is cost savings along with an SMSF compliance guarantee.

5. Credentials and Client Testimonials

The best thing you can do is to sound objective, but your SMSF provider is a credible, experienced, and peer-recommended person. Their history has already revealed a great deal about their ability to provide high-quality and compliant services.

Before the selection of a provider, look out:

- Registered in the SMSF auditor register: A requirement of the ASIC on audit professionals.

- Experience years of outsourcing an SMSF: This would ideally include a client base of individuals to an accountancy firm.

- Case Studies or Reviews: The verified client reports or reviews should demonstrate positive results in compliance, readiness for SMSF audit services, and accuracy of reporting.

- Professional membership/accreditation: Being a member of professional bodies or holding a CPA, CA, or registered tax agent membership or qualification is of great importance in terms of trust and credibility.

Choosing a qualified provider with a good reputation ensures your SMSF is safe. The advantage of this decision is that there will be no waste of money, as you do not pay it to inexperienced service providers who make lots of mistakes.

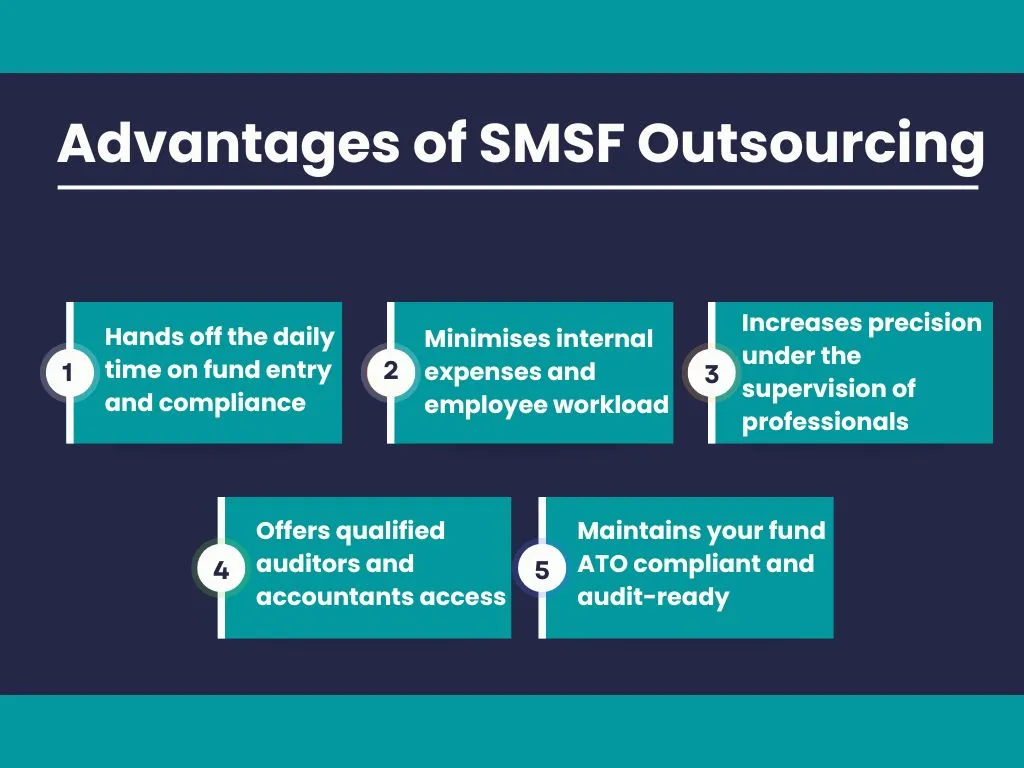

Advantages of SMSF Outsourcing

Whenever you outsource your SMSF, you gain convenience and a sound choice that not only increases the efficiency, accuracy, and compliance rates of the fund but also makes it a wise decision, as it saves you the time and money spent on running and managing the fund. The incremental value that you derive will be measurable and substantial.

Hands off the daily time on fund entry and compliance

Outsourcing saves time and effort expended on transaction processing, records, and ATO deliveries, and additionally enables trustees and advisors to spend more time on decision-making related to investments.

Minimises internal expenses and employee workload

Outsourcing also eliminates the need for SMSF experts or in-house employees, thereby saving accounting firms and financial planners a significant amount of economic resources.

Increases precision under the supervision of professionals

Senior SMSF practitioners minimize the possibility of errors in reporting, calculating, and preparing documents, ensuring your fund can be audited at any time.

Offers qualified auditors and accountants access

Leading providers enjoy direct relationships with licensed SMSF audit services and accredited accountants, so you do not have to hire them yourself.

Maintains your fund ATO compliant and audit-ready

Outsourcing helps you prevent penalties and violations by ensuring that compliance levels are monitored in real-time, facilitating timely lodgments and audit preparation.

Final Thought: Outsource Your SMSF Accounting Needs

The choice of an SMSF outsourcing provider is not only a decision but also a strategic choice of utmost importance that safeguards the integrity of your fund, optimizes efficiency, and ensures long-term compliance. Aone Outsourcing combines its rich industry experience, highly qualified professionals, and innovative systems to deliver end-to-end solutions to SMSFs, individual trustees, and accounting firms in Australia.

Our services combine easy and smooth SMSF accounting and administration, SMSF audit services, and compliance reports, ensuring your fund runs efficiently, accurately, and in complete alignment with ATO regulations.

Seeking a reliable SMSF outsource services provider?

Contact Aone Outsourcing to receive your tailored solution today.

Share this Article