In the competitive and quick-moving world of finance today, firms that provide CPA services are forced to give their clients more value at reasonable costs. Consequently, the demand for flexible and cost-effective accounting solutions has increased. Outsourcing accounting services has become popular around the world.

All around the world, accounting firms from solo to mid-sized are turning to outsourcing accounting for CPAs as an effective way to manage their growing tasks, hire fewer staff, and take advantage of additional skills. It’s not only to save money, it’s to improve operations, add accuracy, and focus mainly on top advisory services.

Outsourcing has led to changes in how accounting is done inside businesses, now letting them share even complex duties such as planning taxes, handling payroll, and projecting financial results. For this reason, outsourced accounting for CPAs has become a central part in today’s accounting, providing firms with important agility, competition, and future-proofing.

What is Accounting Outsourcing?

Accounting Outsourcing for CPA firms means you give your accounting and financial tasks to another company in a different country or region. As a result, CPA firms can work with seasoned experts and advanced systems, all without hiring permanent staff.

What does outsourcing accounting services look like in real life?

Remote, safe, and professional activities like these are all included:

- Bookkeeping and general ledger maintenance

- Accounts receivable and accounts payable management

- Payroll processing

- Tax preparation and compliance

- Financial reporting and analysis

- Audit support

- Services offered by Virtual CFOs

Initially, outsourced bookkeeping for accountants was the most common form of accounting outsourcing for CPAs, ideal for managing day-to-day transactions. Even so, the topic now includes much more than it did before. Now, many providers give access to outsourced CFO services for CPA Firms, supporting accounting and finance with top-level strategy, managing budgets, cash flow, and planning.

Because of technology’s progress and easy access to global experts, accounting outsourcing has become a way for firms to improve services, increase growth, and boost profitability.

%20(1)_1.png)

The Current Outsourcing Trend Around the Globe

Several important trends are leading global CPA firms to outsource accounting tasks:

1. Market Growth:

It is predicted that the global finance and accounting outsourcing market will surpass $56 billion by 2030, thanks to increasing numbers of companies choosing this service to improve how they operate and reduce expenses.

2. Top Outsourcing Locations:

- India: India stands out as a major center with access to abundant and qualified talent, excellent English knowledge, and affordable solutions.

- Philippines: People here are known for being good communicators and fitting well with Western-based organizations.

- Eastern Europe: This region is becoming more popular for European CPA firms because of how close it is, its technological skills, and the time zone differences.

3. Rising Adoption Among Small and Mid-Sized Firms:

Even smaller firms are seeing the advantage of outsourcing to reach their desired levels of production and hire the right expertise during the same period.

4. Technology-Enabled Outsourcing:

Cloud accounting software, Cloud Management Software, and safe online document platforms help businesses outsource more efficiently and reliably, which is prompting more use worldwide.

5. Service Expansion:

Many firms are hiring accountants to take care of more than bookkeeping, providing tax filing, report generation, and CFO guidance. CPA outsourcing services are now an important element in the world of accounting, aiding firms in keeping up with market changes.

Why CPA Firms are Choosing to Outsource?

With so many challenges, hiring a third party to do their accounting is now necessary for CPA firms.

1. Talent Shortage

It is becoming harder and harder to bring in and keep skilled accounting employees. During busy tax periods, there aren’t always enough skilled accountants to meet all the requests for their services. Since the number of candidates is low, CPA firms begin to recruit outside the places they normally look for workers.

2. Compliance Updates

Both financial regulations and tax laws keep changing. CPA firms of all sizes constantly have to build their team’s knowledge and skills to meet compliance regulations.

3. Cost Pressures

Operating with full-time staff and good technology, and still keeping overheads low, can soon decrease a business’s profit margin.

How does outsourcing accounting services help to overcome CPA Firm problems?

- Working with special providers that offer CPA outsourcing services ensures instant access to trained experts who know the newest accounting rules and regulations.

- By using outsourcing, companies can scale their bookkeeping and accounting operations anytime, keeping costs flexible by not having to hire new staff.

- Organizations can spend more time on important job functions and serving clients by handing everyday tasks, like how CPAs can outsource bookkeeping and payroll to someone else.

- Because of better technologies, outsourcing firms deliver real-time financial information with fewer errors.

Essentially, accounting firms should select outsourcing partners who know what accounting firms need, can blend in with their processes, and give top priority to keeping data safe.

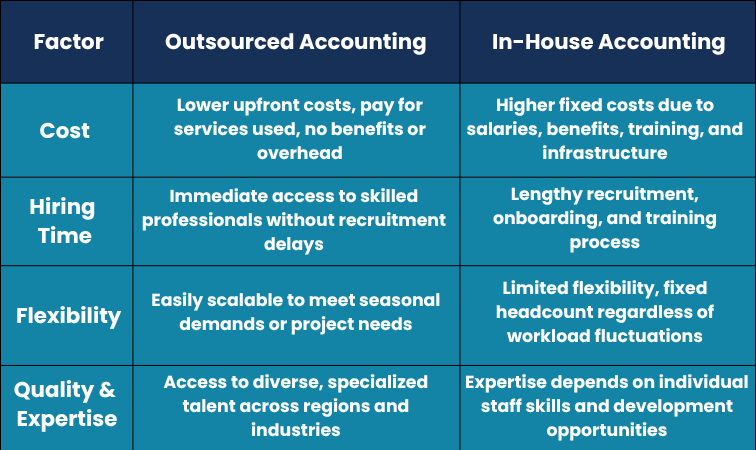

CPA Firm Outsource vs In-House Accounting: A Comparison

CPA firms need to see what benefits and drawbacks exist with using outside accounting firms compared to keeping a team in-house. You can see the differences between them in the comparison table below:

Examples and Cases

- Outsourcing for Seasonal Peak Support: Faced with more work during tax season, a mid-sized CPA firm gave its bookkeeping and payroll jobs to a reliable business. Because of this, meeting deadlines could be met more easily without having too many employees all year.

- In-House for Client Relationship Management: Instead of managing each service personally, the CPA firm preferred to hire a local accountant for close contact with clients and to handle important administrative issues, but relied on specialized agents for everything else.

Benefits of Outsourcing Accounting

_1.jpg)

Outsourcing financial tasks gives CPA firms better efficiency, cuts costs, and makes it easier to focus on strategies for growth. Below are the pros of outsourcing your firm’s accounting.

- Cost Saving: With outsourcing, companies do not need to hire, train, and retain full-time staff, so their expenses are greatly reduced. Using an accounting outsourcing partner means businesses don’t have to spend so much on software, infrastructure, and technology.

- Scalability: Using an outsourcing company gives accounting firms the option to adjust accounting support up or down depending on their current needs. Because of this, businesses can handle busy months like tax season well, even if they don’t need to hire extra staff year-round.

- Access to Expert Talent: When they outsource, companies reach a large group of knowledgeable people who know about tax compliance, audits, and financial analysis. Getting these skills inside an organization can be both difficult and expensive.

- Faster Turnaround Times: Thanks to outsourcing, teams can handle financial processes and compliance in less time than usual because they are available 24/7. It leads to higher levels of responsiveness and makes clients happier.

- Time to Focus on Core Services: Hiring an advisor for routine work lets accountants specialize in key areas like advising clients on investments, looking after relationships, and developing business plans. All things considered, the firm’s value proposition improves.

This is why outsourcing accounting services is now a key approach for CPA firms that want to remain successful and stay ahead in the market.

What CPA Outsourcing Firms Do?

CPA firms use outsourcing to improve how they work and ensure that clients receive the best results. Outsourcing often occurs for many of the tasks listed below.

Bookkeeping

To keep accounts in order, you need to enter every transaction, reconcile banks, and control the ledger. Payroll continues to be the service outsourced most often because it takes much effort and time.

Tax Preparation:

Ensuring that clients stay in compliance with taxes, file accurately, and follow the latest rules, which CPAs can use to reduce risks and get better compliance.

Payroll:

Assigning wages to employees, taking care of taxation, and ensuring all labor regulations are followed, frequently using special knowledge and software.

Financial Reporting:

Preparing statements and reports every month, every quarter, and every year that are accurate and up to standard.

Audit Support:

Supporting with the creation of documents, analysis of data, and talking to auditors to smooth out the whole audit process.

Virtual Assistant Tasks:

A virtual assistant typically assists CPAs by handling administrative and client communication, which gives the CPAs more time for accounting problems.

CFO & Controller-Level Services:

Services like advanced financial planning, budgeting, and managing cash flow, along with strategic advice, are now often outsourced, so companies can hire excellent financial experts without having to pay high executive salaries.

Accounting firms can strengthen their support structure to fit their needs by accessing bookkeeping and accounting for CFO services that are outsourced just for them.

How to Choose the Best Outsourcing Company?

For CPA firms to make the most of outsourcing and avoid risks, choosing their outsourcing accounting services partner wisely is very important. Here is what you should look at when choosing a provider:

Background in International Accounting Standards:

A reliable partner for your firm should know the various accounting rules, like US GAAP, IFRS, UK GAAP, and similar standards, where your clients reside. Because of this, financial statements are accurate and follow the rules.

Technology Compatibility:

The outsourced provider should be compatible with your accounting software, for example, Xero, QuickBooks, NetSuite, Sage, or similar. When your new system flawlessly connects with what you already have, your workflows are made simpler, and the likelihood of errors decreases.

Transparent Communication and Reporting:

Good communication and thorough reports should be maintained constantly. Expect your partner to give real-time updates, notifications, and to be contacted easily for any questions.

Flexible Engagement Models:

You should seek out providers who are flexible with their contracts so you can respond to your firm’s changing requirements.

Client Data Protection and Secure Processes:

Because financial data must be secure, the partner should apply proper security measures such as encryption, safety for their data centers, and restrained access to protect clients’ information.

Checklist: Questions to Ask Before Choosing an Outsourcing Partner

Look through this checklist before picking a company to outsource your CPA services:

Partnering up with someone who meets these requirements helps your CPA firm succeed with accounting outsourcing without giving up on quality, security, or control.

Common Misconceptions and Realities of Outsourcing

Even though more businesses are trying it, people still doubt outsourcing due to false beliefs. Informed knowledge of the facts allows CPA firms to use outsourcing confidently.

Myth 1: Data Security Varies

It’s common for people to fear that their financial data will be exposed when they use an external provider. Top-notch outsourcing companies use high levels of security, such as encrypting all data, storing files securely in the cloud, and meeting international standards such as GDPR and SOC 2. Most smaller or mid-sized companies find that these security measures cost more than they can handle themselves.

Myth 2: Loss of Authority over the Accounting System

CPAs might worry that if functions are outsourced, they won’t be able to supervise the operations themselves. Actually, most partnerships in outsourcing use open communication, common platforms, and real-time dashboards so businesses can see and control everything while using expert help.

Myth 3: Less Effort Is Put into Your Analysis

Some people think that work done by outsourcing services is done quickly and by less skilled staff. Leading outsource companies hire CPAs, ACCAs, or CAs who are experts and use detailed quality control checks to keep work accurate and compliant.

Understanding these accounting outsourcing pros and cons helps firms separate myths from realities, enabling them to leverage outsourcing as a strategic advantage rather than a risk.

Future Outlook: How CPAs Are Adapting to Accounting Outsourcing

There are rapid shifts in outsourced accounting for CPAs because of new technology and what clients expect.

- The Rise of Predictive Accounting and AI: Thanks to artificial intelligence and machine learning, accounting is moving forward by helping predict cash flow, spot possible risks, and automate many duties. When IT shifts in this way, outsourced providers provide more strategic advice and useful information.

- International Collections of Skilled Workers: The range and specialization of talent that can be outsourced are increasing around the world. Accessing qualified specialists in global accounting can be achieved by companies, thanks to online communication.

- Integrated Dashboards and Real-Time Reporting: New outsourcing choices feature platforms that give CPAs online financial data, report templates, and performance insights at any time, improving their business management.

- CPAs Are Increasingly Leading in Advisory Roles: As more things are done automatically or sent elsewhere, CPA firms are now focusing on strategy. Thanks to their outsourcing partners, CPAs can focus on clients and on growing and improving their practices.

As a result, companies will rely more on predictive accounting and advanced outsourcing to keep up with worldwide market changes.

%20(1)_2.png)

Final Thought!

Accounting outsourcing for CPA Firms has become a vital part for those who want to keep up with the speed of today’s financial sector. The main benefits are easily seen: companies save a lot, can easily scale up or down, access a huge talent pool of accountants, and finish key tasks sooner. Most importantly, outsourcing enables CPAs to concentrate on deeper-level services that build up the firm and please clients.

Some companies trust that, by giving work to outsourcers, they could compromise their data privacy. But thanks to Aone Outsourcing, you can be certain that all these worries are handled properly through open processes, reliable data security, and constant management tools. So many firms choose to outsource their accounting because it brings control, safety, and efficiency.

When you’re prepared to use outsourcing to improve your business and boost profits, reach us at Aone Outsourcing. We have built our services to be flexible, secure, and expert-led to serve the specific needs of CPA firms globally. We want to assist you in turning your accounting functions into a key benefit for your business.

Share this Article