Approximately 1 in 3 worldwide businesses suffer from invoice fraud attacks. Manual invoice processing costs businesses at least $15, and based on complexity levels and operational inefficiencies, it can cost as much as $40 per invoice. Companies with lean team members and small to medium businesses face more than a simple inconvenience from this situation. The phone serves as a severe attack on business income and mental peace.

This paper examines how outsourcing your Accounts Payable (AP) processes to outside management allows your business to cut costs, handle money more effectively, and protect against fraud schemes. It describes AP’s typical challenges and risks in manual processing and explains how smart outsourcing offers cost-effective solutions with compliance and scalability benefits.

For small and mid-sized companies, this isn’t just about financial inconvenience; it’s a direct threat to profitability and peace of mind. In this blog, we’ll explore how AP outsourcing services not only help companies cut costs, but also reduce AP fraud risk significantly. You’ll learn how it simplifies workflows, brings in AP automation benefits, and boosts compliance, scalability, and overall accounts payable efficiency.

Why Managing Accounts Payable Is Not as Easy as It Seems

The initial process of accounts payable (AP) management appears straightforward because you receive invoices from suppliers and inspect them before making proper payments. The actual process proves to be complex and becomes more challenging with business growth.

Different payment terms and diverse vendors make invoice management more complicated. Various possible errors when managing accounts payable include delayed payments, together with duplicate or incorrect account deposit activities. Such mistakes result in multiple financial consequences that endanger business relationships and create risks during audits while costing additional expenses.

AP outsourcing services gives businesses access to specialist teams that use automated systems, real-time dashboards, and fraud detection protocols to manage accounts payable from start to finish. The outsourcing process adds expert personnel, advanced systems, and automated tools to enhance efficiency, security, and accuracy.

What Is Accounts Payable Outsourcing?

Third-party providers deliver strategic service through accounts payable outsourcing to professionally manage the entire AP process for their clients. The outsourcing team provides an extended service to your finance department that handles vendor invoices from receipt through approval stages and payment processing, followed by reconciliation activities.

Service providers implement digital workflows together with trained professionals and automated tools to process all invoices accurately, starting from verification until completion. Your streamlined digital workflow provides real-time reporting with error detection and fraud prevention systems instead of working with spreadsheets, along with emails and paper documents.

This method proves effective for organizations no matter their volume of invoices, extending from thirty to three thousand per month. The technology enables organizations to create resilient, cost-efficient protocols for accounts payable while needing to hire a few extra personnel.

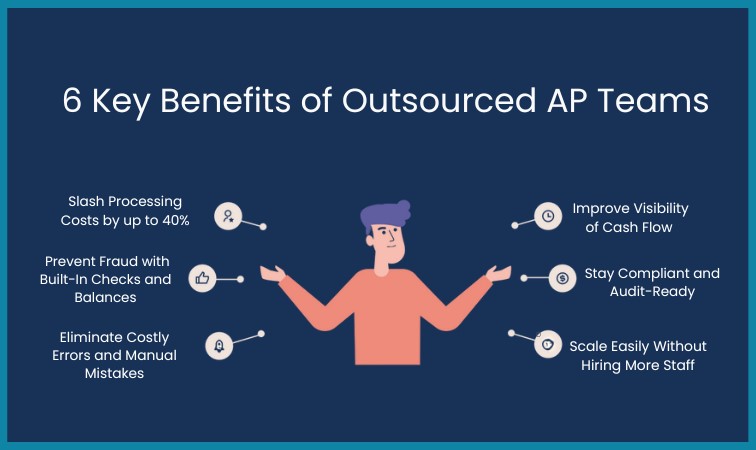

Top Benefits of Outsourced AP Teams

1. Slash Processing Costs by up to 40%

Manual AP systems are cost-heavy. You pay for software licenses, personnel, training, and overhead—all while dealing with inefficiencies. But with AP outsourcing cost reduction, you can achieve cost savings through AP outsourcing by eliminating duplication of efforts, reducing data errors, and speeding up the overall process.

OCR tools, automated workflows, and intelligent approval chains ensure invoices are processed in minutes, not hours. When your AP partner uses economies of scale and smart tech, it saves you both time and money.

Pro Tip: Before comparing outsourcing quotes, tally up your existing AP software costs, staff time, and penalties from late payments. You’ll be surprised how much cheaper outsourcing really is.

2. Prevent Fraud with Built-In Checks and Balances

Fraud doesn’t always start maliciously. Poor controls are sometimes a case of a fake invoice or paying into the wrong account. Unfortunately, it is especially small businesses since they do not have segregation of duties and real-time monitoring.

Fraud prevention is incorporated into every step of an outsourced AP team’s process. Running with dual layer approval, vendor verification systems, and audit-ready documentation guarantees that payments only get directed to validated sources. Duplicate Invoices, mismatches in data and suspect payments attract alerts that inform beforehand about the problems before they become expensive mistakes.

| Pro Tip: Ask your outsourcing partner what kind of anti-fraud and data protection measures they have. Look for tools like vendor validation, restricted payment authorisation, and role-based access to sensitive data. |

3. Eliminate Costly Errors and Manual Mistakes

You can be paying $1,000 instead of $100 for a single misplaced decimal point. By missing a due date, you can expect to be hit with a late fee and impaired supplier relationships. Then, even if errors are made, correcting them is costly to the agency in terms of time and threatens compliance headaches.

Technology, coupled with human review, is what enables AP teams to remain outsourced and remain very high for accuracy. Digitized, they are using automated tools to extract invoice data, validate it, and initiate payments only once it is all passed by trained AP professionals. It tremendously decreases the probability that is of double payment, wrongding, or undiscovered invoice.

| Pro Tip: Find out if your provider uses a “two step verification” process where the first step is done by the computer, and the second by the person. This way, you always know that your payables are accurate and clean. |

4. Improve Visibility of Cash Flow

Poor visibility is one of the most frequent problems in AP. As business owners don’t know which invoices are pending, which invoices are approved and which are getting close to the due date, they don’t know how to plan their cash flow. It ends up with rushed payments, and overdrafts, or even missing early payment discount.

With outsourced AP services, you will get real time access to dashboards, approval status and cash flow forecast. You can schedule payments, manage your working capitol and avoid liabilities.

| Pro Tip: Save yourself from reactive surprises and monitor spend trends, find high volume vendors, and control costs by producing weekly AP reports with your provider. |

5. Stay Compliant and Audit-Ready

In a highly regulated business space, you wouldn’t just hit ‘submit’ here and there; compliance is not a checkbox, it is a must. Small businesses must have accurate and timely AP records to adhere to their tax filing requirements, maintain GST records and be prepared for an audit.

Outsourced teams offer you to constantly stay updated and help you to avoid mistakes and ensure that every payment passes the rules. Also, they keep audit trails of all the transactions, making it easy to answer a query by ATO, to file your BAS report, and prepare for year-end tax.

Pro Tip- Go with a provider who is a specialist in your country’s tax requirements, and he should keep your AP process synchronised with current tax rules and dates.

6. Scale Easily Without Hiring More Staff

And as your business grows, the number of vendors and vendor payments that you have to make also increases. Managing this growth internally sometimes entails hiring more people, buying more software licenses, or spending money on new systems, all of which take time and capital.

Outsourcing offers plug-and-play scalability. Whether it’s 50 invoices this month or 500 invoices next quarter, your outsourcing partner can grow as you do — without new process rework and internal resources.

Pro Tip: Ask your outsourcing partner if they provide a readiness service upgrade if you need to scale up or down instead of being bound to long-term contracts.

Wrapping Up: Choose AP Outsourcing to Make the Smart Move

Such an unglamorous task as accounts payable doesn’t have to put you in a coma. If not appropriately managed, the AP process can be faulty and result in fraud, fines, and angry vendors. But a well-run AP function? That can save your business money and time and improve supplier relationships.

When you outsource your AP to a trustworthy partner such as Aone Outsourcing Solutions, you are outsourcing your payables to the hands of an expert. By taking overhead off your plate, minimising the exposure to loss of funds due to fraud, and having a clear understanding of what you spend, you’ll save some money, have full visibility into your spending, and most importantly, release some precious time to dedicate to growing your business.

Let’s Talk About Smarter Accounts Payable

If you’re tired of wasting time and money on manual, error-prone AP processes, it’s time to explore a smarter solution. At Aone Outsourcing Solutions, we provide end-to-end AP services tailored for growing businesses that want accuracy, compliance, and accounts payable fraud prevention capabilities — all in one place.

Get in touch with our team today to see how outsourced AP can transform the way you manage your finances.

Share this Article