US Expatriation Tax Explained: Exit Tax Rules and Who Must Pay

Leaving the United States forever is not only an emotional or lifestyle move but a major tax event. U.S. citizens and long-term green card holders assume that when they move

Leaving the United States forever is not only an emotional or lifestyle move but a major tax event. U.S. citizens and long-term green card holders assume that when they move

The 2025 tax season is also approaching sooner, making it a better time than ever to track crucial dates, especially for individuals and businesses. This year has a standard IRS

People refer to accounting as the language of business; however, at times, it is not too diplomatic about it. It can feel like a tongue-twister when you are lost in

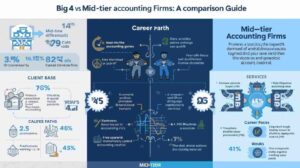

With a competitive and dynamically changing business environment, the success of your company’s finances can be made or broken depending on the accounting partner you settle on. It could be

Why Outsourced Accounting Firms Are Booming in 2025 In 2025, outsourcing accounting is no longer an experiment in the back office; it has become a mainstream business strategy. Due to

Small business owners find it challenging to manage their bookkeeping, as invoices pile up, receipts get lost, and tracking all transactions seems impossible. However, maintaining proper financial accounts is not

Conducting business in the United States is sometimes like having ten balls in the air–sales, marketing, operations, customer service, and… accounting. As all entrepreneurs yearn to grow, maintaining accurate books,