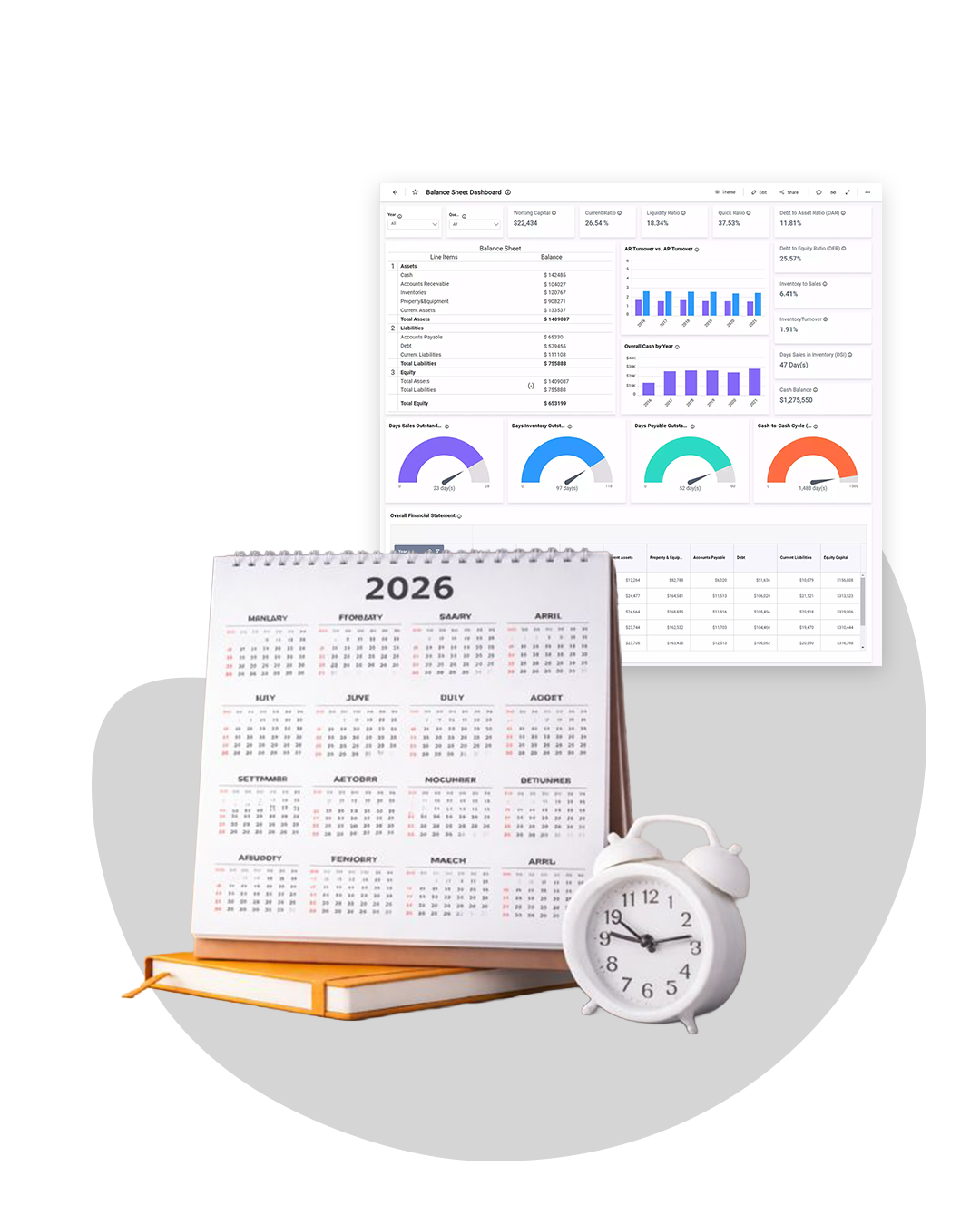

GAAP-compliant, end-of-year finalization services that leave your books in a clean state & balance all your accounts & present your financial statements free from taxes, audits, and strategic planning- without internal overload and last-minute surprises.

Finalization at the year-end is a very important accounting event, which directly affects tax reporting, audit reports, and the accuracy of the financial reporting. In the case of U.S. businesses and CPA firms, a significant delay in filing, audit risk, and a lengthy review period may be caused by the slightest difference at the end of the year that has not been resolved.

As the volume of transactions grows and reporting policies become more demanding, the internal departments may find it difficult to reconcile, book the last adjustments, and make clean schedules within tight timeframes. This stress increases even more in the period of taxation, when accuracy and speed are equally uncompromising.

We offer high-order, CPA compliant finalization services, which include even closing your books and assisting you with preparing your annual reports in compliance with the U.S. GAAP, and have full confidence in the finalization process and outcome. At Aone Outsourcing Solutions, we offer complete and organized end-of-year finalization services as an extension of your accounting team or CPA team to ensure that your books are reconciled, adjusted, and closed in good faith and with full compliance with the U.S. GAAP.

We do a thorough examination of your trial balance at the end of the year to determine inconsistencies, unusual variances, and incomplete posting prior to final close.

All sensitive balance sheet accounts, such as cash, receivables, payables, fixed assets, and liabilities, are reconciled with supporting records.

We also prepare and post annual end adjustments like accruals, prepayments, depreciation, and corrections with full audit trails.

We substantiate period cut-offs in order to record revenue and expenses in the right financial year.

Efforts are made to prepare in detail the schedules and reconciliations to support the tax filings, audit, and CPA reviews.

Your books are closed, and are validated, and aligned to support financial statements of the end of year, tax returns, and management reporting.

We have tailored our finalization procedures to be in line with the CPA review, tax preparation, and audit services, and to have a seamless handoff and quicker approvals.

Operating backward until we reach statutory filing and reporting deadlines, we make sure that your year-end close is prepared on time without the need to make hasty and last-minute amendments.

Both the reconciliation and adjusting entries are backed by accessible work papers and schedules, and hence reviews, audits, and tax filing become easy.

Hire and retire seasoned accounting capacity when needed without long-term hiring, training, and overhead commitments.

The end year close is done by professional people with multi-level quality checks so that consistency and accuracy can be ensured.

We adhere to compliance with U.S. GAAP and keep your financial information secure by means of stringent data security measures.

Aone helped us close the year smoothly with clean books and complete documentation. Our tax filing process was faster than ever.

Aone Outsourcing helped us to have a stress-free, on-time, and compliant year-end close. Their keen eye for detail made us feel entirely confident about our financials.

Our year-end finalization was handled with accuracy and clarity. No follow-ups, no surprises.

Yes. We support U.S. businesses and CPA firms with accurate, GAAP-compliant year-end close and finalization services.

Absolutely. Our scalable solutions are designed to handle increased workloads during year-end close and peak tax season.

Yes. We work seamlessly with your existing accounting systems without requiring any modifications.

Pricing depends on transaction volume, complexity, and timelines. A customized quote is provided based on your specific requirements.

Let us take care of your books and make this financial year a good one.