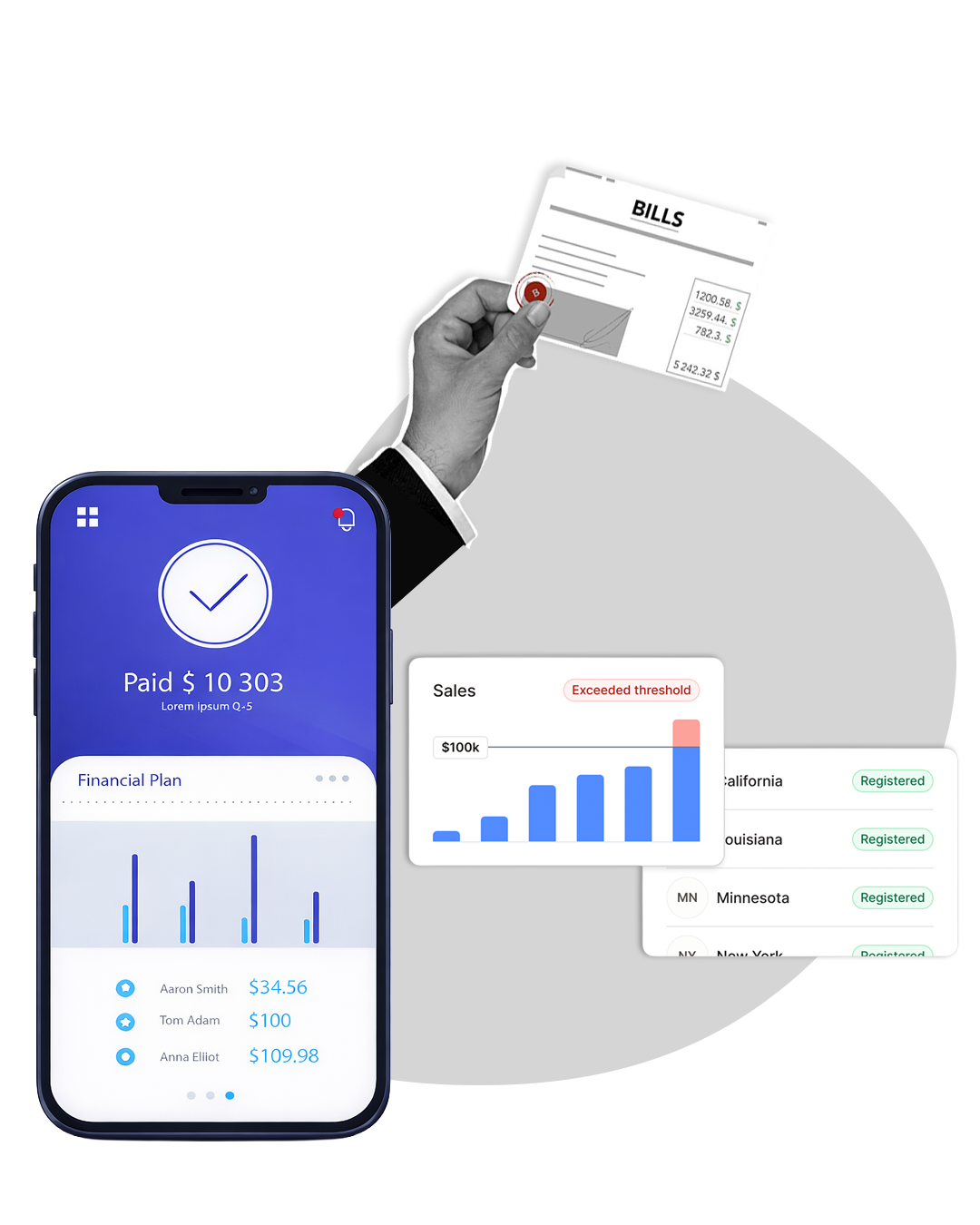

Sales Tax reconciliation Sales tax performance: Reconciliation of sales tax records, making sure that the posted sales tax liability will be congruent with your books, filings, and state records, without internal stacking or compliance danger.

One of the most sensitive and time-consuming accounting tasks among U.S. businesses is sales tax reconciliation. Having different state rates, nexus guidelines, exemptions, and schedules of filing, even the slightest discrepancy between the sales records and the tax filings and the general ledger may lead to penalties, notification, or audit.

Handling such reconciliations in-house may, in a CPA firm and an expanding business, result in lost time, manual reviews, and last-minute corrections, particularly when it's time to file the financial statements and audit seasons.

At Aone Outsourcing Solutions, we offer well-organized, GAAP-aligned sales tax reconciliation services that aim to help you keep your tax liabilities correct, consistent, and defensible. Our team serves as a continuation of your finance or CPA workflow, which provides clean reconciliations to support the filings.

The data regarding taxable and non-taxable sales is analyzed in relation to the systems to ensure accuracy, completeness, and proper classification before the commencement of the reconciliation.

We balance the collected sales tax with the general ledger accounts and present tax returns, and establish differences between books, reports, and state returns.

In the case of business companies that have many jurisdictions, we balance the liabilities of each state, taking into consideration rate differences, exemptions, and nexus regulations.

We match the sales tax returns that have been filed against the recorded liabilities to verify that the amounts recorded, paid, and earned are based on your accounting records.

We mark underpayments, overpayments, differences in timing, and misclassifications, and give clear recommendations on adjustments.

You get well-documented reports on reconciliation that facilitate the in-house reviews, CPA signature, and state audit investigations.

Monthly scale reconciliation support, quarterly scale reconciliation support, or peak filing support-no long-term commitments of hiring.

Our departments are knowledgeable about the complexity of U.S sales tax at the jurisdictional level, industries, and filing specifications.

Open schedules using friendly schedules prepared with supporting evidence are prepared to be reviewed and approved easily by the CPA.

We achieve our deadlines while staying accurate in terms of orderliness in workflow and checkpoints

Account changes are processed by qualified and trained experts, with top-level reviewers, to ensure standardization and accountability.

Any access to data and management of documents is subject to high security and confidentiality measures.

Aone Outsourcing made our sales tax reconciliation process clear. All files were correct, properly documented and submitted within due time.

Aone helped us identify reconciliation gaps we didn't even know existed. Their sales tax reports are clean, accurate, and audit-ready.

Our multi-state sales tax reconciliations are finally under control. No more last-minute corrections or compliance stress.

Yes. We assist U.S.-based businesses and accounting firms in accurately reconciling sales tax obligations in compliance with legal requirements.

Absolutely. We manage sales tax reconciliation across multiple states, handling varying tax rates, rules, and jurisdictional requirements.

Yes. Our sales tax reconciliation services can be delivered on a white-label basis and aligned seamlessly with CPA firm workflows.

Pricing depends on transaction volume, the number of states involved, and reconciliation frequency. A customized quote is provided based on your needs.

Let us take care of your books and make this financial year a good one.